The Sakami Project covering 140 km2 lies about 90 km northwest of the Éléonore mine. It straddles the contact of the Opinaca and La Grande geological subprovinces which offer a variety of settings in which to host gold deposits. Exploration work within and surrounding current project area has taken place since the late 1950s. In early 2000s gold mineralization was discovered at surface near Sakami Lake. This led to the discovery of several mineralized areas hosting variable gold grades*

The focus of recent surface work has been the La Pointe deposit and Simon and JR areas.

Drilling has focused on the La Pointe deposit in which gold occurs at the subprovinces contact in association with structural deformation. A mineralized area has been outlined of 900 m long by 550 m wide along dip and to a depth of 400 m below surface.

Read more about Sakami here

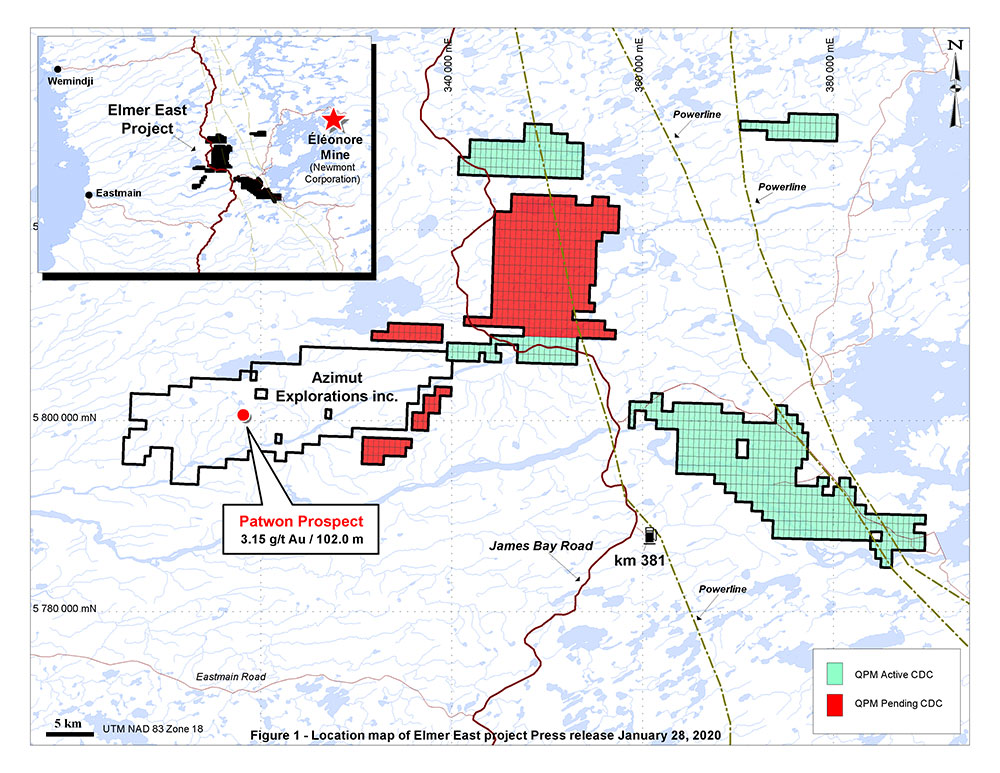

The project is located along trend from the recent Patwon prospect gold discovery made by Azimut Exploration Inc. on its Elmer project located in the Eeyou Istchee James Bay territory, Quebec. The project has strong gold potential totaling 929 claims and includes the adjacent 100% owned Annabelle block(formerly Annabelle project), and the Opinaca Gold West block (formerly Opinaca Gold West project) 561 claims, 295 km2. The western part of the Elmer East project is contiguous to Azimut’s project.

Read more about Elmer East here

Outside of the main holdings discussed, the company has fifteen (15) properties which are currently considered non-core and are up for sale, with no direct activity planned for the 2021 field season. Not all QPM’s non-core properties are related to mining for gold. Several properties obtained during the merger with potential rare earth, nickel-copper, copper-lead-zinc, and graphite deposits are up for grabs while the direction of the company remains fixed on gold. With the expectation that QPM is willing to consider joint venture or option agreements, additional revenues could potentially be generated for the company to further fund its targeted drill program. Three (3) of these properties have since been monetized, generating $2.25 million of cash or value in shares. For the remaining non-essential properties, QPM carries a book value of 1.8 million, and while the amount spent on a project is a poor indication of current market value, the realization of $1 to $3 million for the non-core assets through monetization should be realistically considered.

Read more about Non-Core assets here