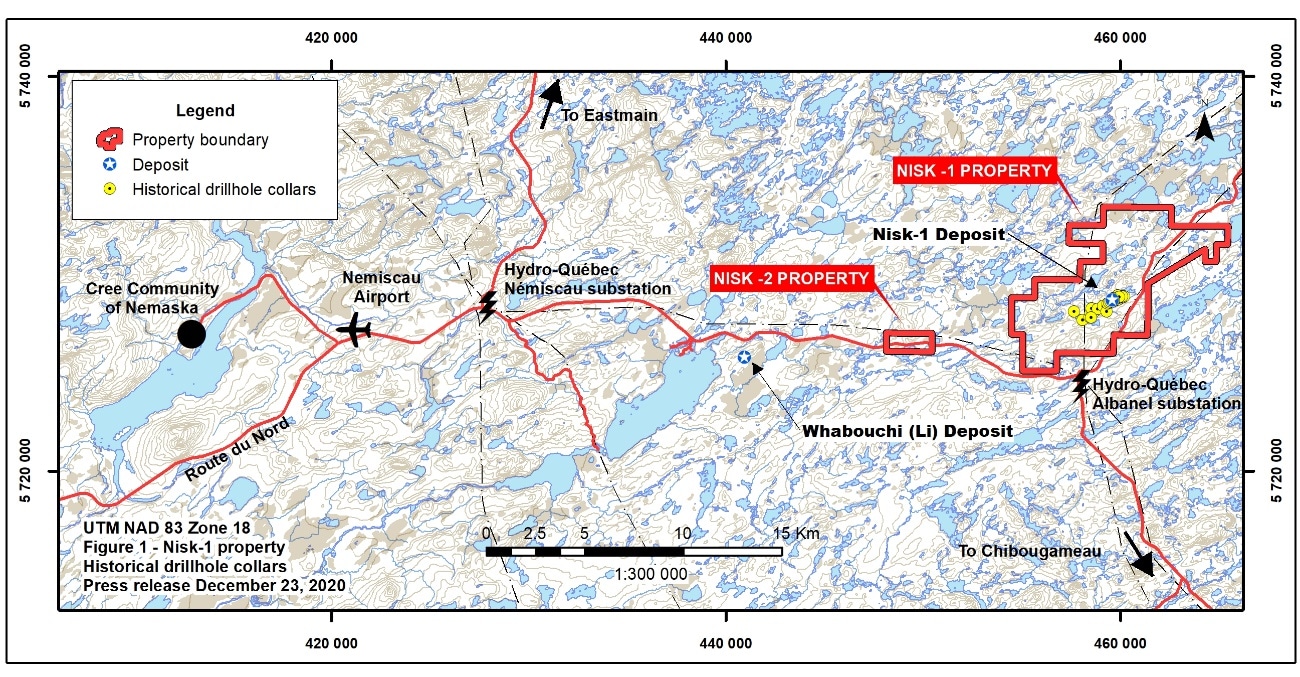

Pending TSX.V approval, CMX has agreed to aquire up to 80% of the NISK property via a series of option payments and work commitments as stated in a recent press release.

The NISK Project comprises a large land position (20km of strike length) with numerous high-grade intercepts outside the current resource area. Chilean is focused on expanding its current high-grade nickel copper PGE mineralization resource prepared in accordance with NI 43-101; identifying additional high-grade mineralization; and developing a process to potentially produce nickel sulphates responsibly for batteries for the electric vehicles industry.

The Company plans to further advance the previously defined historic resources with confirmation drilling, additional infill, and resource definition drilling. An updated resource estimate will be prepared upon completion of the additional drilling. Surface exploration is also contemplated of other prospective targets on the property.

Zulema is located 30 Kilometres from Lundin Mining Corporation’s Candelaria mine and with similar geology, the Company’s Zulema project comprises 4,300 hectares (10,600 acres) in the heart of the productive Atacama mineral belt in Chile’s 3rd Region.

The association of major IOCG-type mineral deposits with the Atacama Fault zone and its splay faults is well-recognized. Candelaria, the world’s second largest “IOCG” deposit* lies adjacent to one such splay fault. Pre-mining reserves at Candelaria were 470Mt @0.95% Cu, 0.22 g/t Au, 3.1 g/t Ag. The Candelaria orebody does not outcrop but is overlain by 100-200m of barren siliceous hornfels and calc-silicate skarn. Copper sulphides occur as stringers, disseminations, breccia in-fillings and mantos. The orebody measures one kilometer in length, 600 metres in depth and is being exploited by low-cost, open pit bulk mining.

The Zulema property is owned 100% by Chilean Metals with no underlying third party royalties or net profits interests. It is road accessible and ideally located at low elevations of less than 400 metres, 30 kms from the mining town of Copaipo, 15 kms from both the Pan-American Highway and Chile’s main northern power grid, and 25 kms from the coast.

Intensely skarned hydrothermal breccia is exposed on the property over an area of one square km and is open to extension beneath sand plains. Sporadic but widespread disseminated copper oxides on surface assay in the range of 0.4 to 5.5% Cu and 0.2 to 0.4 gpt Au. Previous drilling at the extreme southern tip of the main prospective area encountered up to 22 metres of 0.45% Cu and 0.11 grams/tonne Au in stockworks.

Read more about Zulema here

The contiguous Palo Negro and Hornitos properties, 100% owned by Chilean Metals, together comprise over 9,000 hectares (23,000 acres) in the Atacama Province of Chile’s Third Region. The properties cover a 14 km strike length of the Atacama Structural Zone, locus of numerous high-grade Cu, Au, Ag and Fe deposits including the large Candelaria deposit of Lundin Mining Corporation less than 30 km to the northeast. Pre-mining reserves at the Candelaria IOCG deposit stood at 470Mt grading 0.95% Cu, 0.22 g/t Au and 3.1 g/t Ag.

Lying on a splay fault of the Atacama Structural Zone, Candelaria is the largest of the iron oxide copper-gold deposits in the Punta del Cobre belt, and the second largest IOCG deposit in the world after Olympic Dam, Australia.

The Palo Negro and Hornitos properties are easily accessible by a network of well-maintained gravel roads 10 km from the Pan-American Highway. The properties are well situated for low-cost exploration and future mine development.

The Osorniña mine is situated on a small third party concession within the Palo Negro property. Magnetic surveys show an intense magnetic response over a strike length of 2.5 kms extending well beyond the Osorniña mine and coincident with the Atacama fault. Meta-sediments and meta-volcanics in this area have been hydrothermally altered by the introduction of iron oxides and copper. This and similar magnetic anomalies delineated over the Palo Negro & Hornitos properties are priority IOCG targets.

IOCG deposits are generally responsive to magnetic and induced polarization (IP) surveys. Future exploration of the Palo Negro and Hornitos properties will require further geophysical surveys to define exploration targets, followed by reverse circulation drilling.

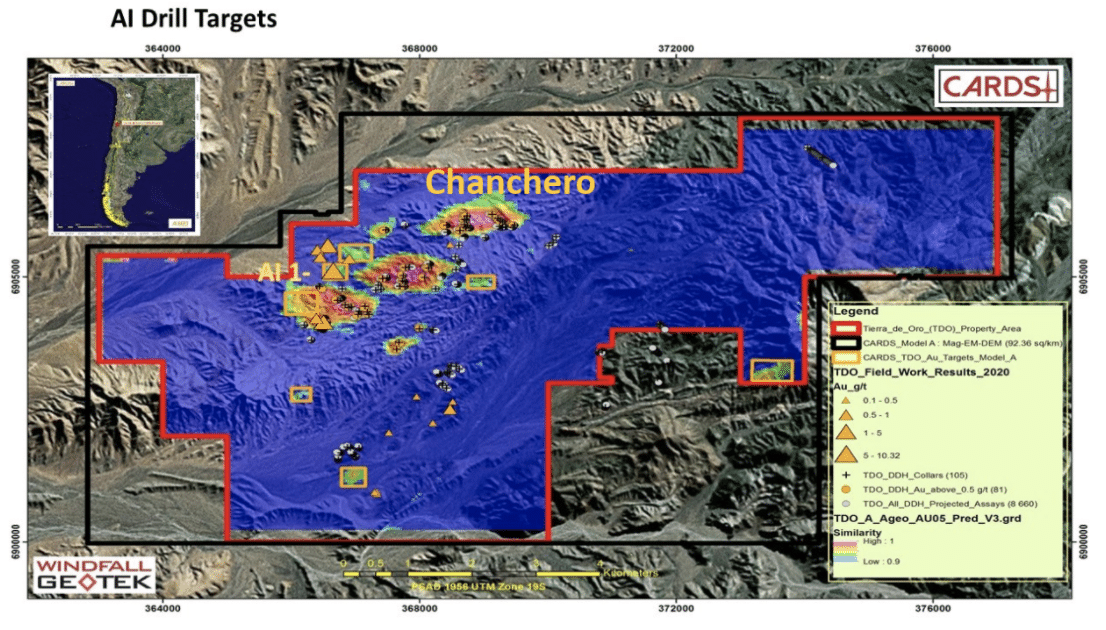

Chilean Metals’ wholly-owned Tierra de Oro (TDO) property is located in Chile’s prolific IOCG (iron oxide-copper-gold) belt. The belt hosts numerous copper-gold deposits including Mantos Blancos, Manto Verde and the nearby Candelaria IOCG deposit, owned by Lundin Mining Corporation, with reported reserves and production of 470 Mt at 0.95 % Cu, 0.22 g/t Au, 3.1 g/t Ag.

This 5,600 hectare (14,000 acre) property is located 70 kms south of the mining town of Copiapo in Chile’s Third Region. It lies 20 km east of both the Pan American Highway and Chile’s main power grid and is accessed by well-maintained gravel roads. With a maximum elevation of only 1,500 meters the property enjoys good climactic conditions allowing year-round exploration. TDO hosts bulk-tonnage Au-Cu-Ag exploration targets.

Geologically, the property is underlain by two distinct domains: a Western Domain of intrusive rocks with Au-Cu mineralization, and an Eastern Domain of volcanic strata with Cu-Ag mineralization. The two domains are separated by a major north-easterly trending fault, a splay of the main Atacama Fault some 20 kilometres further west.

The Western Domain presents several inadequately-tested gold exploration targets. Previous exploration was focused principally on establishing a resource on gold veins developed and mined in past years by artisanal miners. These veins locally contain in excess of an ounce per ton of gold. Individual veins can be traced on surface for up to a kilometer but are generally narrow and discontinuous, pinching and swelling like beads on a string. Several bulk-rn mineable targets have been identified, the most promising of which is the Cerro Chanchero zone where strong Au-Cu soil geochemical anomalies coincide with a prominent IP (induced polarization) anomaly and intense argillic alteration. Previous drill holes which tested the periphery of this target encountered abundant disseminated pyrite. The 500m x 250m core of this promising porphyry Au-Cu target remains untested by drill holes.

Read more about Tierra De Oro here

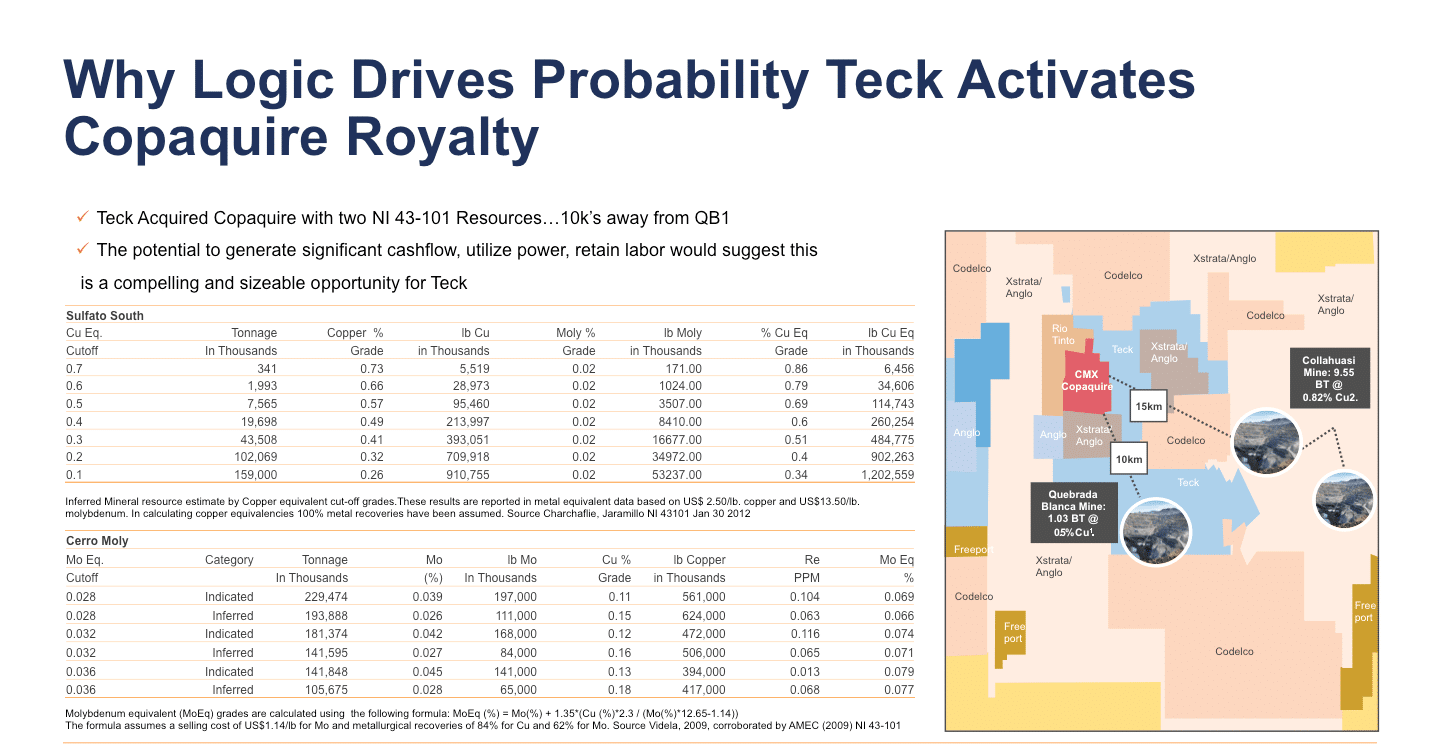

Copaquire Royalty

Chilean Metals sold its Copaquire property to Teck Resources Limited for Cad. $3,033,500, with CMX retaining a 3% NSR (net smelter return) royalty on production. Teck has the right to purchase one third of the NSR for Cad. $3,000,000, thereby presenting the Company with near-term cash flow potential. By way of comparison, total sales in 2013 at Quebrada Blanca, Teck’s nearby copper mine and SXEW operation, were $422 Million. The royalty, whether 3% or reduced to 2% through Teck exercising its right, has potential to provide significant future benefit to the Company in terms of non-dilutive exploration funding and/or dividends to our shareholders, and may provide a model for the Company’s future accretive growth.

Copaquire is located in Chile’s 1st Region, 125 kms south of its capital city, Iquique, on upland plateau in a very well-endowed mineral neighbourhood and readily accessible via well-maintained all-weather roads. The project adjoins Teck’s Quebrada Blanca mine, where leachable copper reserves will be depleted by 2016 at current production and reserve levels (Teck website). Anglo-Xstrata-Mitsui’s colossal Collahuasi copper mine also lies nearby.

Read more about Copaquire Royalty here